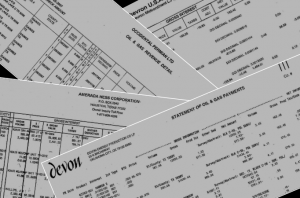

Oil and gas monthly check details can be confusing and less than transparent. Often, only oil and gas accounting specialists, with knowledge of upstream accounting and marketing practices, can decipher royalty checks and monthly details. Nonetheless, understanding these materials will help to ensure that you’re receiving the correct amount of royalty payment, under your lease and the law of your state, each and every month.

There is no standard format for a monthly check detail – but there are many similar terms on the statements. Most royalty statements will have the property/well name, decimal interest, an API number, county and state, production month and year, product type, price per MCF or BBL, and volume of production. Further, more complicated information appears also – such as gross and net volumes and price calculations, severance and production taxes (on gross and net bases), royalty interests and types, and, occasionally, post-production deductions. You may see deductions on your royalty statement each month, but not necessarily so. Many royalty payors imbed such deductions into calculations of prices, volumes and amounts owed. Also, deductions can vary each month. The quickest way to check for unnecessary deductions is to refer back to your lease, in order to learn which deductions are allowed, and which not. Make sure that the deductions listed on the royalty statement are allowed according to the lease. Also, hire oil and gas oil and gas accounting specialists, and legal specialists on upstream marketing, in order better to understand your royalty checks and monthly details.

Holmes PLLC has extensive experience in reviewing royalty statements and monitoring statements to ensure correct payments according to the lease.