Rich gas (also called wet gas) contains valuable natural gas liquids, like ethane, propane, butane and pentane. Is a royalty owner receiving royalties on such liquids?

In states like Texas that do not embrace the “marketable condition rule,” a royalty owner with a traditional royalty clause – meaning the clause doesn’t forbid lessening gas royalties with post-production costs – may not be receiving gas royalties on the valuable liquids derived from gas. Whether the producer (lessee) is paying royalties on liquids derived from the gas depends on the wellhead purchase price structure under which the producer sells the gas. The producer may sell the gas to a purchaser-processor under a gas contract containing this sort of price structure:

“PRICE: After Producer delivers more than 500 MCF per month to Processor, the price to be paid to Producer at the Delivery Point by Processor shall be 40% of the Henry Hub spot price for NatGas as reported monthly by the U.S. Energy Information Administration (https://www.eia.gov) for the month of delivery times the measured volume of gas for the same month, or 75 cents per MCF, whichever is higher.”

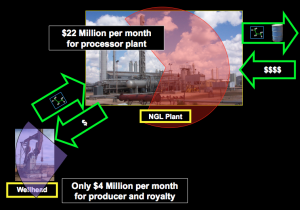

This sort of price structure does not attempt to compensate the producer for the liquids content in the gas. If the foregoing formula does approximate the value of the liquid content, it does so merely by accident. Consequently, a royalty owner having a producer with such a gas contract will not receive gas royalties on the valuable liquids derived from gas.

The producer, on the other had, may sell the gas to a purchaser-processor under a gas contract containing this sort of price structure:

“PRICE: The price to be paid to Seller at the Delivery Point by Processor shall be 77.5% of the gross value of Residue Gas and 65% of the gross value of Plant Products [liquids] sold by Processor. Notwithstanding the above, for any month that the total volume of gas sold by Processor from receipts through Producer’s Delivery Point(s) within that month exceeds 250 MCF/Day over the full month, the price to be paid to Producer at the Delivery Point by Processor shall be 85% of the gross value of Residue Gas and 75% of the gross value of Plant Products sold by Processor.”

Though not perfectly, the foregoing price structure attempts to compensate the producer for the liquids content in the gas. Consequently, a royalty owner having a producer with such a gas contract will receive gas royalties on most of the valuable liquids derived from gas.

Holmes PLLC specializes in understanding the marketing arrangement for, and processing practices behind, deriving natural gas liquids from gas streams of various contents, and in various parts of the country. The firm frequently assists royalty owners to understand whether their producers (lessees) are paying royalties on liquids derived from the gas, and which wellhead purchase prices are affecting gas royalties. The firm assists royalty owners in establishing their rights to the valuable liquid content of gas streams.